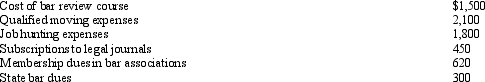

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Myra's classification of those who work for

Q108: Once set for a year, when might

Q123: Christopher just purchased an automobile for $40,000

Q131: A taxpayer just changed jobs and incurred

Q133: Brian makes gifts as follows:

Q134: What originally led to the cutback adjustment?

Q135: Rocky has a full-time job as an

Q138: Regarding § 222 (qualified higher education deduction

Q140: A taxpayer has multiple jobs at different

Q141: Ramon and Ingrid work in the field

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents