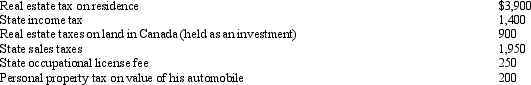

During 2010,Sam,a self-employed individual,paid the following amounts:  What amount can Sam claim as taxes in itemizing deductions from AGI?

What amount can Sam claim as taxes in itemizing deductions from AGI?

A) $6,600.

B) $6,950.

C) $7,200.

D) $8,600.

E) None of the above.

Correct Answer:

Verified

Q66: David, a single taxpayer, took out a

Q67: Pedro's child attends a school operated by

Q70: Nick made the following contributions this year

Q72: Brad,who uses the cash method of accounting,lives

Q73: Mel made the following donations to charity

Q75: In 2010,Roseann makes the following donations to

Q77: Sarah,John's daughter who would otherwise qualify as

Q78: Nancy paid the following taxes during the

Q79: Karen,a calendar year taxpayer,made the following donations

Q97: Pat died this year.Before she died, Pat

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents