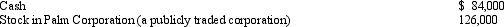

Nick made the following contributions this year to the University of the West:  Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

A) $75,600.

B) $84,000.

C) $126,000.

D) $210,000.

E) None of the above.

Correct Answer:

Verified

Q61: Emily, who lives in Indiana, volunteered to

Q65: Joseph and Sandra,married taxpayers,took out a mortgage

Q66: Phil is advised by his family physician

Q67: Pedro's child attends a school operated by

Q68: Terry pays $8,000 this year to become

Q72: Brad,who uses the cash method of accounting,lives

Q73: Mel made the following donations to charity

Q74: During 2010,Sam,a self-employed individual,paid the following amounts:

Q75: In 2010,Roseann makes the following donations to

Q97: Pat died this year.Before she died, Pat

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents