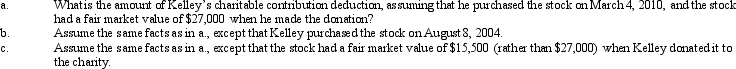

Kelley,who has AGI of $250,000,owns stock in Blue Corporation with a basis of $20,000.He donates the stock to a qualified charitable organization on July 5,2010.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: David, a single taxpayer, took out a

Q77: Sarah,John's daughter who would otherwise qualify as

Q78: Nancy paid the following taxes during the

Q79: Karen,a calendar year taxpayer,made the following donations

Q80: Your friend Scotty informs you that he

Q81: Harry and Sally were divorced three years

Q85: Several years ago,Ross,who is single,purchased a personal

Q86: George is single and has AGI of

Q87: During the current year, Maria and her

Q98: Which of the following items would be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents