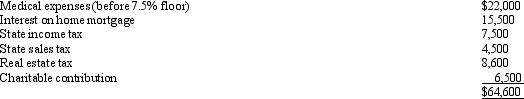

George is single and has AGI of $262,450 in 2010.His potential itemized deductions before any limitations for the year total $64,600 and consist of the following:

After all necessary adjustments are made,what is the amount of itemized deductions George may claim?

After all necessary adjustments are made,what is the amount of itemized deductions George may claim?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Harry and Sally were divorced three years

Q81: Kelley,who has AGI of $250,000,owns stock in

Q85: Several years ago,Ross,who is single,purchased a personal

Q87: During the current year, Maria and her

Q87: Wilma,who uses the cash method of accounting,lives

Q88: Shannon traveled to San Francisco during the

Q91: Linda borrowed $60,000 from her parents for

Q98: Which of the following items would be

Q100: Donald owns a principal residence in Chicago,

Q104: Frank, a widower, had a serious stroke

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents