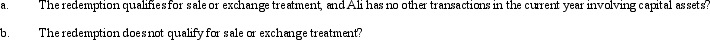

Ali is in the 35% tax bracket.He acquired 1,000 shares of stock in Cardinal Corporation seven years ago for $100 a share.In the current year,Cardinal Corporation (E & P of $1 million)redeems all of his shares for $300,000.What are the tax consequences to Ali if:

Correct Answer:

Verified

Q117: In the current year,Loon Corporation made a

Q118: Lupe and Rodrigo,father and son,each own 50%

Q119: The adjusted gross estate of Debra,decedent,is $8

Q120: Brenda owns 900 shares of Eagle Corporation

Q121: Brown Corporation has 1,000 shares of common

Q124: The gross estate of Raul,decedent who died

Q125: Noncorporate and corporate shareholders typically do not

Q126: Sam's gross estate includes stock in Tern

Q127: Silver Corporation has accumulated E & P

Q170: Briefly describe the reason a corporation might

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents