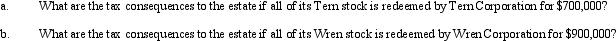

Sam's gross estate includes stock in Tern Corporation and Wren Corporation,valued at $700,000 and $900,000,respectively.At the time of Sam's death in 2009,the stock represented 27% of Tern's outstanding stock and 38% of Wren's outstanding stock.Sam's adjusted gross estate equals $4,400,000.Death taxes and funeral and administration expenses for Sam's estate total $700,000.Sam had a basis of $120,000 in the Tern stock and $300,000 in the Wren stock at the time of his death.None of the beneficiaries of Sam's estate own (directly or indirectly)any stock in Wren Corporation,but some of the beneficiaries own stock of Tern Corporation.Consider the following independent questions.

Correct Answer:

Verified

Q121: Brown Corporation has 1,000 shares of common

Q122: Ali is in the 35% tax bracket.He

Q124: The gross estate of Raul,decedent who died

Q125: Noncorporate and corporate shareholders typically do not

Q127: Silver Corporation has accumulated E & P

Q128: Honeysuckle Corporation is wholly owned by Tabatha.Corporate

Q129: Jill has a capital loss carryover in

Q130: Stephanie is the sole shareholder and president

Q131: Hummingbird Corporation has 1,000 shares of common

Q170: Briefly describe the reason a corporation might

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents