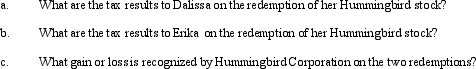

Hummingbird Corporation has 1,000 shares of common stock outstanding owned by unrelated parties as follows: Juan,300 shares,Erika,300 shares,and Dalissa,400 shares.Each of the three shareholders paid $75 per share for the Hummingbird stock 10 years ago.Hummingbird has $800,000 of accumulated E & P and $40,000 of current E & P.In January of the current year,Hummingbird distributes land held as an investment (adjusted basis of $260,000,fair market value of $220,000)to Dalissa in redemption of all 400 of her shares.In December of the current year,Hummingbird distributes securities held as an investment (adjusted basis of $90,000,fair market value of $110,000)to Erika in redemption of 200 of her shares.

Correct Answer:

Verified

Q111: Thistle Corporation declares a nontaxable dividend payable

Q126: Sam's gross estate includes stock in Tern

Q127: Silver Corporation has accumulated E & P

Q128: Honeysuckle Corporation is wholly owned by Tabatha.Corporate

Q129: Jill has a capital loss carryover in

Q130: Stephanie is the sole shareholder and president

Q134: Rosie,the sole shareholder of Eagle Corporation,has a

Q136: Puce Corporation,an accrual basis taxpayer,has struggled to

Q144: Explain the requirements for waiving the family

Q145: What are the tax consequences of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents