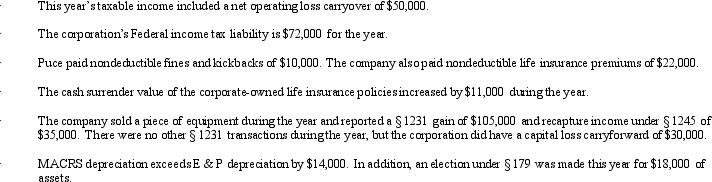

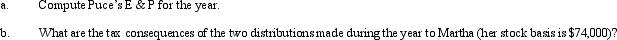

Puce Corporation,an accrual basis taxpayer,has struggled to survive since its formation,six years ago.As a result,it has a deficit in accumulated E & P at the beginning of the year of $340,000.This year,however,Puce earned a significant profit;taxable income was $240,000.Consequently,Puce made two cash distributions to Martha,its sole shareholder: $150,000 on July 1 and $200,000 December 31.The following information might be relevant to determining the tax treatment of the distributions.

Correct Answer:

Verified

Q111: Thistle Corporation declares a nontaxable dividend payable

Q126: Sam's gross estate includes stock in Tern

Q127: Silver Corporation has accumulated E & P

Q128: Honeysuckle Corporation is wholly owned by Tabatha.Corporate

Q129: Jill has a capital loss carryover in

Q130: Stephanie is the sole shareholder and president

Q131: Hummingbird Corporation has 1,000 shares of common

Q134: Rosie,the sole shareholder of Eagle Corporation,has a

Q144: Explain the requirements for waiving the family

Q145: What are the tax consequences of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents