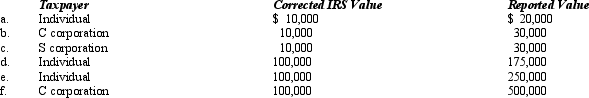

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 35%.

Correct Answer:

Verified

Q89: A taxpayer can take a dispute to

Q99: A penalty for understating a tax liability

Q100: Failure to file and failure to pay

Q102: A penalty can be assessed from an

Q102: List several current initiatives that the IRS

Q103: A CPA and a taxpayer can keep

Q104: Isaiah filed his Federal income tax return

Q105: Kim underpaid her taxes by $30,000.Of this

Q106: Carol's AGI last year was $180,000.Her Federal

Q110: A _% penalty may result when a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents