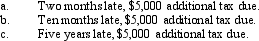

Isaiah filed his Federal income tax return on time,but he did not remit the full balance due.Compute Isaiah's failure to pay penalty in each of the following cases.The IRS has not yet issued a deficiency notice.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: A penalty for understating a tax liability

Q100: Failure to file and failure to pay

Q101: Compute the overvaluation penalty for each of

Q102: List several current initiatives that the IRS

Q103: A CPA and a taxpayer can keep

Q105: Kim underpaid her taxes by $30,000.Of this

Q106: Carol's AGI last year was $180,000.Her Federal

Q107: Orville,a cash basis,calendar year taxpayer,filed his income

Q108: Rhoda,a calendar year individual taxpayer,files her 2008

Q109: Yin-Li is the preparer of the Form

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents