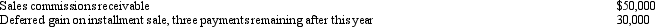

Bob is one of the income beneficiaries of the LeMans Estate,which is subject to a 45% marginal Federal estate tax rate,a 35% marginal Federal income tax rate,and a 5% marginal state income tax rate.This year,Bob received all of the sales commissions that were earned and payable to Violet LeMans (cash basis)at her death.Compute Bob's § 691(c)deduction for the current year,given the following data.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: The Prasad Trust operates a welding business.Its

Q103: What is a simple trust? A complex

Q104: The LMN Trust is a simple trust

Q107: The Purple Trust incurred the following items

Q108: An estate has $100,000 DNI,composed of $50,000

Q109: When a beneficiary receives a distribution from

Q109: Identify the parties that are present when

Q112: A Form 1041 must be filed by

Q116: Income beneficiary Molly wants to receive all

Q116: Remainder beneficiary Shelley receives a $50,000 net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents