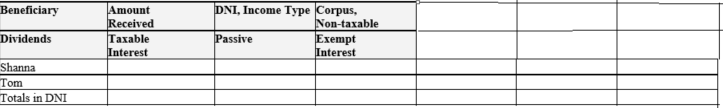

An estate has $100,000 DNI,composed of $50,000 dividends,$20,000 taxable interest,$10,000 passive income,and $20,000 tax-exempt interest.The trust's two noncharitable income beneficiaries,Shanna and Tom,receive distributions of $75,000 each.How much of each class of income is deemed to have been distributed to Shanna? To Tom? Use the following template to structure your answer.

Correct Answer:

Verified

Q103: What is a simple trust? A complex

Q104: The LMN Trust is a simple trust

Q105: Bob is one of the income beneficiaries

Q107: The Purple Trust incurred the following items

Q109: Identify the parties that are present when

Q111: The Cooper Trust is required to distribute

Q112: A Form 1041 must be filed by

Q112: Are estates and trusts taxed like individuals?

Q113: Determine the tax effects of the indicated

Q116: Remainder beneficiary Shelley receives a $50,000 net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents