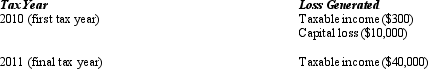

Determine the tax effects of the indicated losses for the Yellow Estate for both tax years.The estate holds a variety of investment assets,which it received from the decedent,Mrs.Yellow.The estate's sole income and remainder beneficiary is Yellow,Jr.

Correct Answer:

Verified

Q108: An estate has $100,000 DNI,composed of $50,000

Q109: Identify the parties that are present when

Q111: The Cooper Trust is required to distribute

Q112: Are estates and trusts taxed like individuals?

Q114: How does the alternative minimum tax affect

Q115: The LMN Trust is a simple trust

Q116: Remainder beneficiary Shelley receives a $50,000 net

Q117: Complete the chart below,indicating trust accounting income

Q118: The Form 1041 of a calendar-year trust

Q150: How is entity accounting income computed? What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents