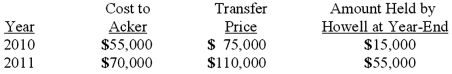

Acker Inc. bought 40% of Howell Co. on January 1, 2010 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1,440,000. Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2010 and $120,000 in 2011 while paying $40,000 in dividends each year.

What is the amount of unrealized intra-entity inventory profit to be deferred on December 31, 2011?

A) $1,600.

B) $8,000.

C) $15,000.

D) $20,000.

E) $40,000

Correct Answer:

Verified

Q75: On January 1, 2011, Jackie Corp. purchased

Q76: Acker Inc. bought 40% of Howell Co.

Q77: On January 4, 2011, Bailey Corp. purchased

Q78: Cayman Inc. bought 30% of Maya Company

Q79: Cayman Inc. bought 30% of Maya Company

Q91: How should an investor account for, and

Q109: What argument could be made against the

Q115: How would a change be made from

Q116: You are auditing a company that owns

Q118: What is the primary objective of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents