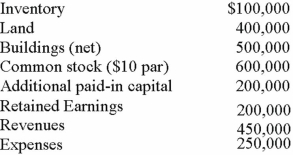

Carnes has the following account balances as of May 1, 2012 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

What will be the consolidated additional paid-in capital as a result of this acquisition?

A) $440,000.

B) $740,000.

C) $750,000.

D) $940,000.

E) $950,000.

Correct Answer:

Verified

Q54: On January 1, 2013, the Moody Company

Q55: The financial balances for the Atwood Company

Q56: The financial balances for the Atwood Company

Q57: On January 1, 2013, the Moody Company

Q58: The financial balances for the Atwood Company

Q60: The financial balances for the Atwood Company

Q61: Presented below are the financial balances for

Q62: Flynn acquires 100 percent of the outstanding

Q63: Presented below are the financial balances for

Q64: Presented below are the financial balances for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents