Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2013. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

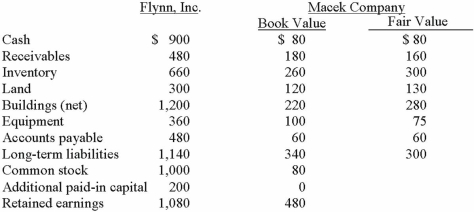

The book values for both Flynn and Macek as of January 1, 2013 follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.

By how much will Flynn's additional paid-in capital increase as a result of this acquisition?

A) $150,000.

B) $160,000.

C) $230,000.

D) $350,000.

E) $360,000.

Correct Answer:

Verified

Q57: On January 1, 2013, the Moody Company

Q58: The financial balances for the Atwood Company

Q59: Carnes has the following account balances as

Q60: The financial balances for the Atwood Company

Q61: Presented below are the financial balances for

Q63: Presented below are the financial balances for

Q64: Presented below are the financial balances for

Q65: Presented below are the financial balances for

Q66: The financial balances for the Atwood Company

Q67: Presented below are the financial balances for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents