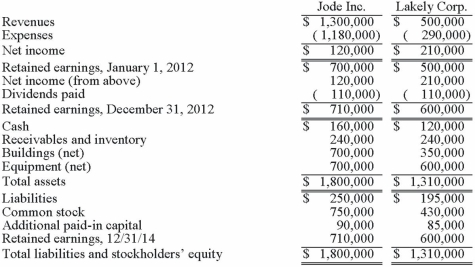

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2012, follow. Lakely's buildings were undervalued on its financial records by $60,000.

On December 31, 2012, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

Determine consolidated Additional paid-in Capital at December 31, 2012.

Correct Answer:

Verified

Q98: What term is used to refer to

Q101: Salem Co. had the following account balances

Q102: Salem Co. had the following account balances

Q103: Jernigan Corp. had the following account balances

Q104: On January 1, 2013, Chester Inc. acquired

Q105: For each of the following situations, select

Q106: The following are preliminary financial statements for

Q110: How is contingent consideration accounted for in

Q111: How are bargain purchases accounted for in

Q119: How would you account for in-process research

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents