Analysis and calculations should be made based on current Canadian GAAP.

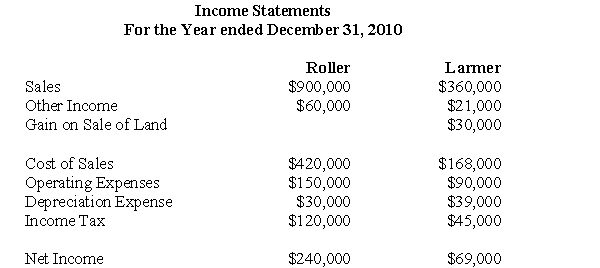

The following are the 2010 Income Statements of Roller Corp and Larmer Corp.  Other Information:

Other Information:

During 2010 Larmer paid dividends of $24,000.Roller acquired its 30% stake in Roller at a cost of $400,000 and uses the cost method to account for its investment.Roller's investment in Larmer shall not be considered a control investment.

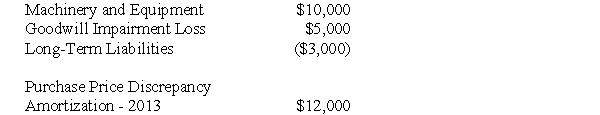

The acquisition differential amortization schedule showed the following write-off for 2010:  During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

In 2010,Roller sold Land to Larmer and recorded a profit of $10,000 on the sale.During 2010,Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

-Assuming that Larmer is NOT a joint venture and that it is also NOT a portfolio investment,prepare Roller's 2010 Income Statement in accordance with current Canadian GAAP.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Using only the Profit test, which of

Q60: Which of the following was often cited

Q61: X Ltd.and Y Ltd.For a joint venture

Q62: ABC Inc.has acquired all of the voting

Q63: ABC invested $30 million in cash

Q65: Analysis and calculations should be based on

Q66: Calculations and analysis should be based on

Q67: Globecorp International has six operating segments,the details

Q68: X Ltd.and Y Ltd.For a joint venture

Q69: Calculations and analysis should be based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents