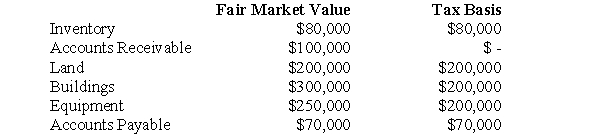

ABC Inc.has acquired all of the voting shares of DEF Inc and is gathering the necessary data to prepare consolidated financial statements.ABC paid $1,200,000 for its investment.Details of the companies' assets and liabilities on the acquisition date are shown below:

Required:

Assuming that DEF hasn't set up Deferred Tax Asset or Liability accounts,determine the amounts that would be used to prepare the Consolidated Balance Sheet on the acquisition date.Assume a tax rate of 50%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Using only the Profit test, which of

Q57: What is the amount of the Deferred

Q58: What is the amount of the Deferred

Q60: Which of the following was often cited

Q61: X Ltd.and Y Ltd.For a joint venture

Q63: ABC invested $30 million in cash

Q64: Analysis and calculations should be made based

Q65: Analysis and calculations should be based on

Q66: Calculations and analysis should be based on

Q67: Globecorp International has six operating segments,the details

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents