Calculations and analysis should be based on current Canadian GAAP.

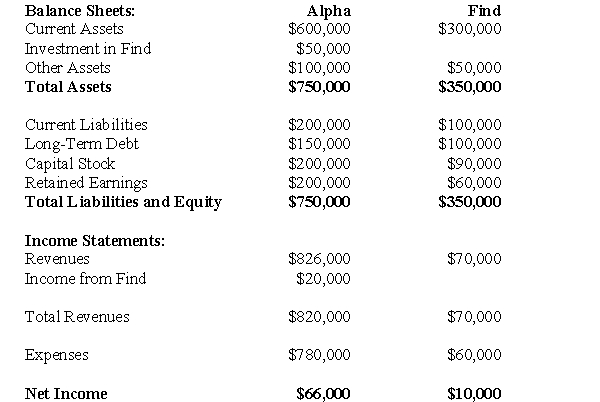

On January 1,2006,Alpha,Beta and Gamma agree to enter into a joint venture and thereby formed Find Corp.Alpha contributed 40% of the assets to the venture,which was also its stake in the venture.Presented below are the financial statements of Alpha and Find as at December 31,2010:  Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha supplies Find with an important component that is used by Find as it carries out its business activities.The December 31,2010 inventory of Find contains items purchase from Alpha on which Alpha recorded a gross profit of $10,000.Intercompany sales are always priced to provide the seller with a gross margin of 40% on sales.Both companies are subject to a tax rate of 40%.On December 31,2010,Find still owed $5,000 to Alpha for unpaid invoices.

-Prepare a schedule of intercompany items as at December 31,2010.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Analysis and calculations should be based on

Q66: Calculations and analysis should be based on

Q67: Globecorp International has six operating segments,the details

Q68: X Ltd.and Y Ltd.For a joint venture

Q69: Calculations and analysis should be based on

Q71: A Corp.and B Corp.formed a joint venture

Q72: Analysis and calculations should be made based

Q73: Analysis and calculations should be based on

Q74: A Corp.and B Corp.formed a joint venture

Q75: Analysis and calculations should be based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents