Analysis and calculations should be based on the requirements of current Canadian GAAP.

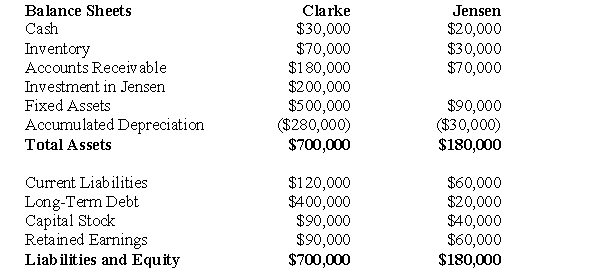

The following balance sheets have been prepared on December 31,2010 for Clarke Corp.and Jensen Inc.  Additional Information:

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen,which it acquired on January 1,2007.On that date,Jensen's retained earnings were $20,000.The acquisition differential was fully amortized by the end of 2010.

Clarke sold Land to Jensen during 1999 and recorded a $15,000 gain on the sale.Clarke is still using this Land.Clarke's December 31,2010 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2010 interest-free.Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

-Prepare a Balance Sheet for Clarke on December 31,2010 in accordance with current Canadian GAAP,assuming that Clarke's Investment in Jensen is a joint venture investment.

Correct Answer:

Verified

Q65: Analysis and calculations should be based on

Q66: Calculations and analysis should be based on

Q67: Globecorp International has six operating segments,the details

Q68: X Ltd.and Y Ltd.For a joint venture

Q69: Calculations and analysis should be based on

Q70: Calculations and analysis should be based on

Q71: A Corp.and B Corp.formed a joint venture

Q72: Analysis and calculations should be made based

Q73: Analysis and calculations should be based on

Q74: A Corp.and B Corp.formed a joint venture

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents