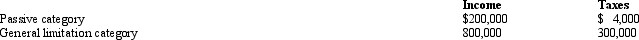

BendCo,Inc. ,a U.S.corporation,has foreign-source income and pays foreign taxes as follows.

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

Correct Answer:

Verified

FTC is lesser of fore...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Discuss the primary purposes of income tax

Q133: History,Inc. ,a domestic corporation,owns 60% of the

Q141: Discuss the policy reasons for the §

Q142: KeenCo, a domestic corporation, is the sole

Q144: Describe the importance of determining whether a

Q145: Describe the policy reasons behind treating foreign

Q146: Given the following information,determine whether Greta,an alien,is

Q149: BrazilCo,Inc. ,a foreign corporation with a U.S.trade

Q153: During 2010,Martina,an NRA,receives interest income of $50,000

Q158: Arendt, Inc., a domestic corporation, purchases a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents