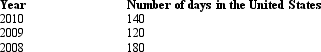

Given the following information,determine whether Greta,an alien,is a U.S.resident for 2010.Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q133: History,Inc. ,a domestic corporation,owns 60% of the

Q141: Discuss the policy reasons for the §

Q141: Given the following information,determine if FanCo,a foreign

Q142: Austin,Inc. ,a domestic corporation,generates U.S.-source and foreign-source

Q142: KeenCo, a domestic corporation, is the sole

Q144: Describe the importance of determining whether a

Q145: Describe the policy reasons behind treating foreign

Q148: BendCo,Inc. ,a U.S.corporation,has foreign-source income and pays

Q149: BrazilCo,Inc. ,a foreign corporation with a U.S.trade

Q158: Arendt, Inc., a domestic corporation, purchases a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents