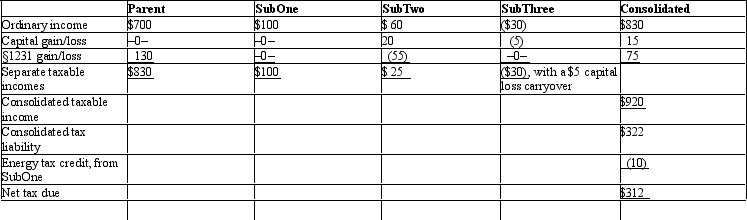

The Parent consolidated group reports the following results for the tax year.Determine each member's share of the consolidated tax liability,assuming that the members all have consented to use the relative taxable income tax-sharing method.Dollar amounts are listed in millions,and a 35% marginal income tax rate applies.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Sub sells an asset to Parent at

Q83: Parent Corporation owns 100% of the stock

Q84: Calendar year Parent Corporation acquired all of

Q85: The group of Parent Corporation,SubOne,and SubTwo has

Q86: Parent Corporation's current-year taxable income included $100,000

Q87: LargeCo files on a consolidated basis with

Q90: Compute consolidated taxable income for the calendar

Q92: ParentCo's controlled group includes the following members.ParentCo

Q93: Compute consolidated taxable income for the calendar

Q131: How many consolidated tax returns are filed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents