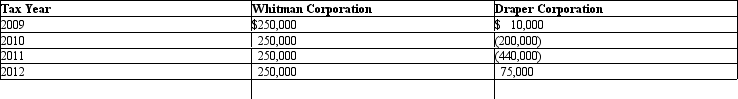

Compute consolidated taxable income for the calendar year Whitman Group,which elected consolidated status immediately upon creation of the two member corporations in January 2009.All recognized income related to the data processing services of the firms.No intercompany transactions were completed during the indicated years.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Sub sells an asset to Parent at

Q88: The Parent consolidated group reports the following

Q90: Compute consolidated taxable income for the calendar

Q92: ParentCo's controlled group includes the following members.ParentCo

Q94: In the current year,Parent Corporation provided advertising

Q95: ParentCo and SubCo had the following items

Q96: ParentCo and SubCo had the following items

Q97: Except for the § 199 domestic production

Q98: ParentCo's separate taxable income was $200,000,and SubCo's

Q131: How many consolidated tax returns are filed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents