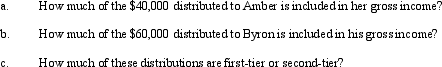

The Cooper Trust is required to distribute $80,000 annually,split equally between its two income beneficiaries,Amber and Byron.If trust income is not sufficient to pay these amounts,the trustee can invade corpus to the extent necessary.During the current year,the trust has DNI of $50,000.Byron receives an additional $20,000 discretionary corpus distribution.

Correct Answer:

Verified

Q49: Three months after Emma died,her executor received

Q58: The trustee of the Epsilon Trust distributed

Q70: Which of the following is the annual

Q76: The Roz Trust has distributable net income

Q80: The Roz Trust has distributable net income

Q82: An estate has $100,000 DNI,composed of $50,000

Q83: The LMN Trust is a simple trust

Q90: The Yellow Trust incurred $10,000 of portfolio

Q91: Jose is subject to the top marginal

Q96: The Drabb Trust owns a plot of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents