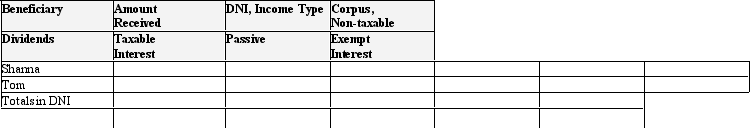

An estate has $100,000 DNI,composed of $50,000 dividends,$20,000 taxable interest,$10,000 passive income,and $20,000 tax-exempt interest.The trust's two noncharitable income beneficiaries,Shanna and Tom,receive distributions of $75,000 each.How much of each class of income is deemed to have been distributed to Shanna? To Tom? Use the following template to structure your answer.

Correct Answer:

Verified

Q49: Three months after Emma died,her executor received

Q70: Which of the following is the annual

Q76: The Roz Trust has distributable net income

Q80: The Roz Trust has distributable net income

Q81: The Cooper Trust is required to distribute

Q83: The LMN Trust is a simple trust

Q87: The Purple Trust incurred the following items

Q90: The Yellow Trust incurred $10,000 of portfolio

Q91: Jose is subject to the top marginal

Q96: The Drabb Trust owns a plot of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents