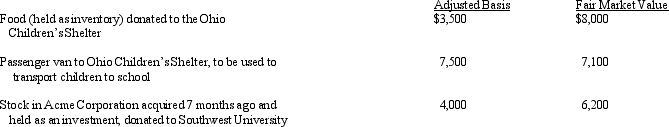

Grocer Services Corporation (a calendar year taxpayer) ,a wholesale distributor of food,made the following donations to qualified charitable organizations during the year:

How much qualifies for the charitable contribution deduction?

A) $15,000.

B) $16,850.

C) $17,250.

D) $19,450.

E) None of the above.

Correct Answer:

Verified

Q61: Hippo,Inc. ,a calendar year C corporation,manufactures golf

Q74: Red Corporation,which owns stock in Blue Corporation,had

Q76: During the current year,Kingbird Corporation (a calendar

Q77: Orange Corporation owns stock in White Corporation

Q78: Sage, Inc., a closely held corporation that

Q79: Emerald Corporation,a calendar year C corporation,was formed

Q80: Copper Corporation owns stock in Bronze Corporation

Q81: Canary Corporation,an accrual method C corporation,uses the

Q83: During the current year,Yellow Company had operating

Q113: Shareholders of closely held C corporations frequently

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents