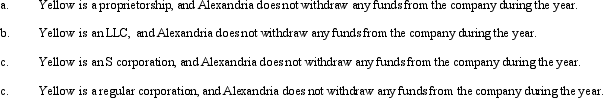

During the current year,Yellow Company had operating income of $380,000 and operating expenses of $300,000.In addition,Yellow had a long-term capital loss of $50,000.Based on this information,how does Alexandria,the sole owner of Yellow Company,report this information on her individual income tax return under following assumptions?

Correct Answer:

Verified

Q78: Sage, Inc., a closely held corporation that

Q78: Grocer Services Corporation (a calendar year taxpayer),a

Q79: Emerald Corporation,a calendar year C corporation,was formed

Q81: Canary Corporation,an accrual method C corporation,uses the

Q85: Warbler Corporation,an accrual method regular corporation,was formed

Q86: Ostrich,a C corporation,has a net short-term capital

Q87: During the current year,Coyote Corporation (a calendar

Q87: Maroon Company had $150,000 net profit from

Q92: Almond Corporation,a calendar year C corporation,had taxable

Q113: Shareholders of closely held C corporations frequently

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents