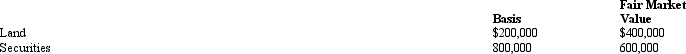

Curt owns the following assets which he gives to his daughter Carla in 2009 (no gift tax results) .

Both items have been held by Curt as an investment for more than one year.If Carla immediately sells these assets for $1 million ($400,000 + $600,000) ,she recognizes:

A) No gain or loss.

B) A $200,000 STCG and no loss.

C) A $200,000 STCG and $200,000 STCL.

D) A $200,000 LTCG and no loss.

E) A $200,000 LTCG and $200,000 LTCL.

Correct Answer:

Verified

Q73: Paul dies and leaves his traditional IRA

Q85: In making gifts of property to family

Q86: Which of the following procedures carried out

Q87: Scott makes a gift of stock in

Q88: In January 2009,Clint makes a gift of

Q91: After a prolonged illness,Claire has been diagnosed

Q93: In 1990,Gloria purchased as an investment unimproved

Q95: In June 2008,Debra makes a gift of

Q96: Becky inherited property from her mother seven

Q97: Which, if any, of the following items

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents