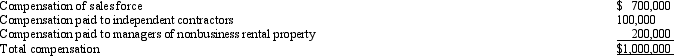

State D has adopted the principles of UDITPA.Given the following transactions for the year,determine Comp Corporation's D payroll factor denominator.

A) $700,000.

B) $800,000.

C) $900,000.

D) $1,000,000.

Correct Answer:

Verified

Q64: Bert Corporation,a calendar-year taxpayer,owns property in States

Q65: In the broadest application of the unitary

Q70: A use tax:

A)Applies when a State A

Q72: Peete Corporation is subject to franchise tax

Q73: A taxpayer wishing to reduce the negative

Q74: When the taxpayer has exposure to a

Q74: Trayne Corporation's sales office and manufacturing plant

Q89: Parent and Junior form a non-unitary group

Q95: A state sales tax usually falls upon:

A)

Q111: The benefits of a passive investment company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents