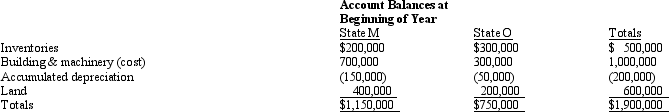

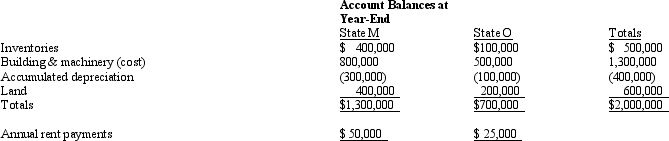

Bert Corporation,a calendar-year taxpayer,owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost,and O requires that the property be included in the property factor at its net depreciated book value.

Bert's M property factor is:

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

Correct Answer:

Verified

Q22: Typically exempt from the sales/use tax base

Q49: The model law relating to the assignment

Q69: State D has adopted the principles of

Q70: A use tax:

A)Applies when a State A

Q73: A taxpayer wishing to reduce the negative

Q74: When the taxpayer has exposure to a

Q77: In conducting multistate tax planning,the taxpayer should:

A)Review

Q80: In most states,a limited liability company (LLC)is

Q89: Parent and Junior form a non-unitary group

Q101: Parent and Junior form a unitary group

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents