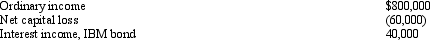

You are completing the State A income tax return for Quaint Company.Quaint is a limited liability company,and it operates in various states,showing the following results.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Assuming the following data are correct,compute Quaint's A taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Indicate for each transaction whether a sales

Q87: Although Bowl Corporation's manufacturing facility,distribution center,and retail

Q88: Identify some of the areas of the

Q93: Compute Quail Corporation's State Q taxable income

Q106: Polly is an employee of a consulting

Q111: Define the terms allocation and apportionment as

Q113: List some of the most commonly encountered

Q117: List which items are included in the

Q127: Hermann Corporation is based in State A

Q183: Identify some state/local income tax issues facing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents