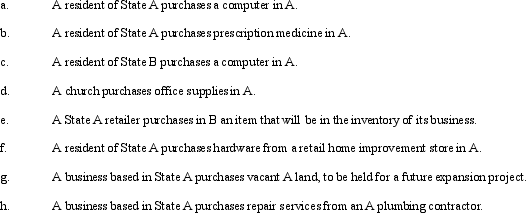

Indicate for each transaction whether a sales (S)or use (U)applies,or whether the transaction is nontaxable (N).Where the laws vary among various states,assume that the most common rules apply.All taxpayers are individuals.

Correct Answer:

Verified

Q81: Flake Corporation's property holdings in State E

Q83: Garcia Corporation is subject to tax in

Q87: Although Bowl Corporation's manufacturing facility,distribution center,and retail

Q88: Identify some of the areas of the

Q90: You are completing the State A income

Q101: In multistate income taxation,the sales factor applies

Q106: Polly is an employee of a consulting

Q111: Define the terms allocation and apportionment as

Q173: What is the significance of the term

Q183: Identify some state/local income tax issues facing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents