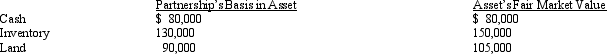

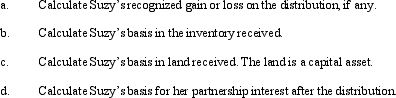

Suzy owns a 25% capital and profits interest in the calendar-year SJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating current distribution of the following assets:

Correct Answer:

Verified

Q83: Cindy,a 20% general partner in the CDE

Q87: The December 31,2010,balance sheet of the calendar-year

Q88: In a proportionate liquidating distribution in which

Q90: Joe has a 25% capital and profits

Q91: The December 31,2010,balance sheet of the BCD

Q92: Rita sells her 25% interest in the

Q95: The JIH Partnership distributed the following assets

Q96: The December 31,2010,balance sheet of the DIP

Q139: Which of the following is not true

Q224: Susan is a one-fourth limited partner in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents