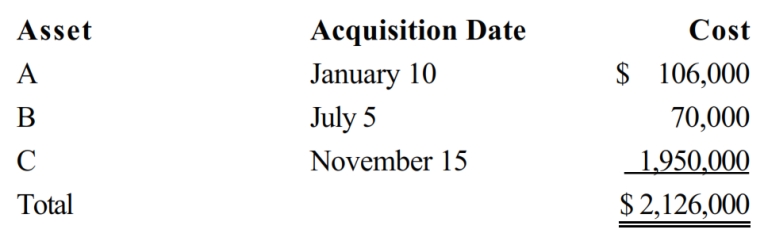

Audra acquires the following new five-year class property in 2018:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra does not claim any available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Discuss the difference between the half-year convention

Q108: Discuss the tax implications of a seller

Q110: On July 15, 2018, Mavis paid $275,000

Q111: Norm purchases a new sports utility vehicle

Q113: Discuss the requirements in order for startup

Q115: On April 5, 2018, Orange Corporation purchased,

Q116: Discuss the beneficial tax consequences of an

Q117: Sid bought a new $1,320,000 seven-year class

Q118: Lindsey purchased a uranium interest for $10,000,000

Q119: On August 20, 2018, May placed in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents