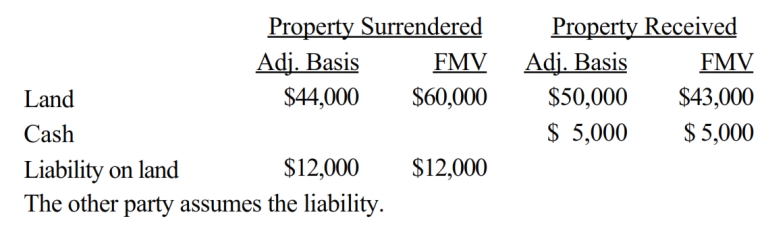

Sammy exchanges land used in his business in a like-kind exchange. The property exchanged is as follows:

a. What is Sammy's recognized gain or loss?

b. What is Sammy's basis for the assets he received?

Correct Answer:

Verified

Q183: Jacob owns land with an adjusted basis

Q199: Marsha transfers her personal use automobile to

Q212: Discuss the effect of a liability assumption

Q216: When a property transaction occurs, what four

Q224: Patty's factory building, which has an adjusted

Q226: Lucinda, a calendar year taxpayer, owned a

Q227: Carlos, who is single, sells his personal

Q231: Use the following data to determine the

Q232: Evelyn's office building is destroyed by fire

Q234: For the following exchanges, indicate which qualify

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents