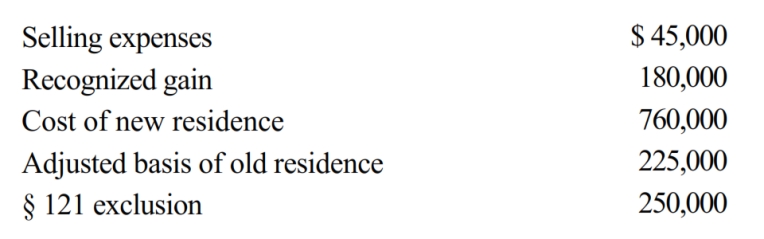

Use the following data to determine the sales price of Etta's principal residence and the realized gain. She is not married. The sale of the old residence qualifies for the § 121 exclusion.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: Jacob owns land with an adjusted basis

Q199: Marsha transfers her personal use automobile to

Q212: Discuss the effect of a liability assumption

Q226: Lucinda, a calendar year taxpayer, owned a

Q227: Carlos, who is single, sells his personal

Q229: Sammy exchanges land used in his business

Q232: Evelyn's office building is destroyed by fire

Q234: For the following exchanges, indicate which qualify

Q235: For each of the following involuntary conversions,

Q236: Katrina, age 58, rented (as a tenant)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents