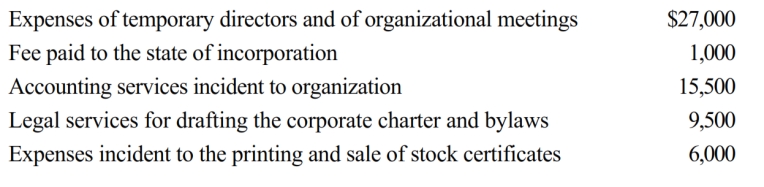

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2018. The following expenses were incurred during the first tax year (April 1 through December 31, 2018) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

Correct Answer:

Verified

Q67: Opal Corporation, an accrual method, calendar year

Q68: Rodney, the sole shareholder of Orange Corporation,

Q69: Schedule M-1 of Form 1120 is used

Q70: Nancy Smith is the sole shareholder and

Q71: Orange Corporation, a calendar year C corporation,

Q73: In working with Schedule M-2 (analysis of

Q74: During the current year, Sparrow Corporation, a

Q75: In the current year, Crimson, Inc., a

Q76: Copper Corporation, a calendar year C corporation,

Q77: Schedule M-1 of Form 1120 is used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents