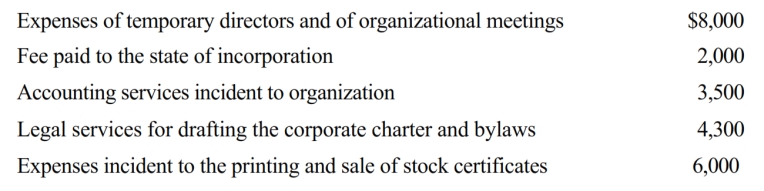

Opal Corporation, an accrual method, calendar year taxpayer, was formed and began operations on July 1, 2018. The following expenses were incurred during the first tax year (July 1 through December 31, 2018) of operations.  Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

A) $593.

B) $460.

C) $5,427.

D) $5,627.

E) None of the above.

Correct Answer:

Verified

Q23: Luis is the sole shareholder of a

Q62: Which of the following statements is incorrect

Q63: In the current year, Red Corporation (a

Q64: During the current year, Jay Corporation, a

Q66: Eagle Corporation, a calendar year C corporation,

Q68: Rodney, the sole shareholder of Orange Corporation,

Q69: Schedule M-1 of Form 1120 is used

Q70: Nancy Smith is the sole shareholder and

Q71: Orange Corporation, a calendar year C corporation,

Q72: Emerald Corporation, a calendar year C corporation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents