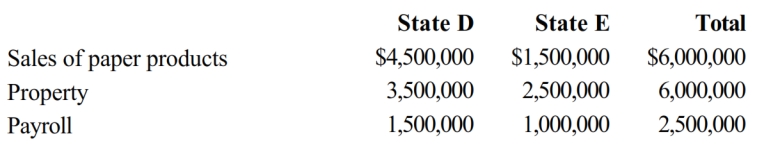

Milt Corporation owns and operates two facilities that manufacture paper products. One of the facilities is located in State D, and the other is located in State E. Milt generated $1,200,000 of taxable income, comprised of $1,000,000 of income from its manufacturing facilities and a $200,000 gain from the sale of nonbusiness property located in E. E does not distinguish between business and nonbusiness property. D apportions business income. Milt's activities within the two states are outlined below.

Both D and E utilize a three-factor apportionment formula, under which sales, property, and payroll are equally weighted. Determine the amount of Milt's income that is subject to income tax by each state.

Correct Answer:

Verified

Q142: Match each of the following items with

Q143: Match each of the following events considered

Q149: Match each of the following items with

Q150: Match each of the following items with

Q172: Compute Still Corporation's State Q taxable income

Q173: Hill Corporation is subject to tax only

Q174: Match each of the following items with

Q177: Match each of the following items with

Q178: Condor Corporation generated $450,000 of state taxable

Q181: Franz Corporation is based in State A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents