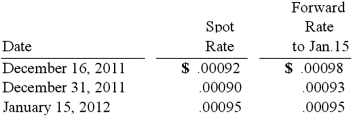

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2011, with payment of 10 million Korean won to be received on January 15, 2012. The following exchange rates applied:  Assuming a forward contract was entered into, what would be the net impact on Car Corp.'s 2011 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

Assuming a forward contract was entered into, what would be the net impact on Car Corp.'s 2011 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

A) $700 (gain) .

B) $700 (loss) .

C) $300 (gain) .

D) $300 (loss) .

E) $295 (gain) .

Correct Answer:

Verified

Q1: Norton Co., a U.S. corporation, sold inventory

Q2: Car Corp. (a U.S.-based company) sold parts

Q3: Meisner Co.ordered parts costing §100,000 for a

Q6: Belsen purchased inventory on December 1, 2010.

Q7: On June 1, CamCo received a signed

Q8: Car Corp. (a U.S.-based company) sold parts

Q9: Norton Co., a U.S. corporation, sold inventory

Q10: Mills Inc. had a receivable from a

Q11: The forward rate may be defined as

A)

Q11: Pigskin Co., a U.S. corporation, sold inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents