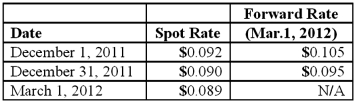

On December 1, 2011, Joseph Company, a U.S. company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2012, as a fair value hedge of a foreign currency denominated account payable. The following U.S. dollar per peso exchange rates apply:  Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2011 balance sheet for the forward contract?

Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2011 balance sheet for the forward contract?

A) $5,146.58 asset.

B) $5,146.58 liability.

C) $500.00 liability.

D) $490.15 asset.

E) $490.15 liability.

Correct Answer:

Verified

Q42: Winston Corp., a U.S. company, had the

Q43: Woolsey Corporation, a U.S. company, expects to

Q44: On May 1, 2011, Mosby Company received

Q44: Lawrence Company, a U.S.company, ordered parts costing

Q45: On March 1, 2011, Mattie Company received

Q46: On April 1, Quality Corporation, a U.S.

Q47: On March 1, 2011, Mattie Company received

Q51: Woolsey Corporation, a U.S. company, expects to

Q55: Larson Company, a U.S.company, has an India

Q60: Williams, Inc., a U.S.company, has a Japanese

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents