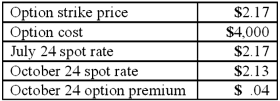

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:  What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

A) $6,000 positive.

B) $6,000 negative.

C) $10,000 positive.

D) $10,000 negative.

E) $14,000 positive.

Correct Answer:

Verified

Q44: Lawrence Company, a U.S.company, ordered parts costing

Q46: On December 1, 2011, Joseph Company, a

Q47: On March 1, 2011, Mattie Company received

Q52: On May 1, 2011, Mosby Company received

Q53: Parker Corp., a U.S. company, had the

Q54: Winston Corp., a U.S. company, had the

Q55: Larson Company, a U.S.company, has an India

Q55: Atherton, Inc., a U.S. company, expects to

Q56: Parker Corp., a U.S. company, had the

Q60: Williams, Inc., a U.S.company, has a Japanese

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents