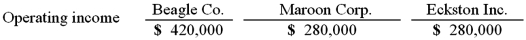

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Operating income totals for 2011 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 unrealized gain on intra-entity transfers to Maroon.  The accrual-based income of Beagle Co. is calculated to be

The accrual-based income of Beagle Co. is calculated to be

A) $706,670.

B) $755,980.

C) $805,280.

D) $838,150.

E) $815,770.

Correct Answer:

Verified

Q19: River Co. owned 80% of Boat Inc.

Q20: Prescott Corp. owned 90% of Bell Inc.,

Q21: Hardford Corp. held 80% of Inglestone Inc.

Q25: On January 1, 2010, Jones Company bought

Q27: Tower Company owns 85% of Hill Company.

Q28: Hardford Corp. held 80% of Inglestone Inc.

Q29: Which of the following statements is true

Q29: The benefits of filing a consolidated tax

Q29: Hardford Corp. held 80% of Inglestone Inc.

Q38: When indirect control is present, which of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents