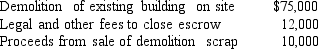

On July 1,2016,Larkin Co.purchased a $400,000 tract of land that is intended to be the site of a new office complex.Larkin incurred additional costs and realized salvage proceeds during 2016 as follows:

What would be the balance in the land account as of December 31,2016?

A) $400,000.

B) $475,000.

C) $477,000.

D) $487,000.

Correct Answer:

Verified

Q25: The capitalized cost of equipment excludes:

A) Maintenance.

B)

Q26: The exclusive right to benefit from a

Q27: Holiday Laboratories purchased a high-speed industrial centrifuge

Q29: Assets acquired by the issuance of equity

Q31: Use the following to answer questions

Montana Mining

Q32: Use the following to answer questions

Montana Mining

Q33: If a company incurs disposition obligations as

Q33: The exclusive right to display a symbol

Q39: Juliana Corporation purchased all of the outstanding

Q44: Assets acquired under multi-year deferred payment contracts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents