Essay

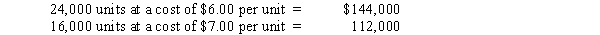

The Foxworthy Corporation uses a periodic inventory system and the LIFO inventory cost method for its one product.Beginning inventory of 40,000 units consisted of the following,listed in chronological order of acquisition:

During 2016,inventory quantity declined by 18,000 units.All units purchased during 2016 cost $8.00 per unit.

Required:

Calculate the before-tax LIFO liquidation profit or loss that the company would report in a disclosure note assuming the amount determined is material.

Correct Answer:

Verified

Related Questions