The following information comes from the 2013 Occidental Petroleum Corporation annual report to shareholders:

NOTE 4 INVENTORIES

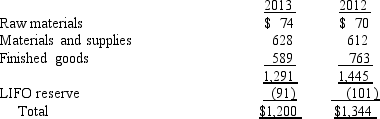

Net carrying values of inventories valued under the LIFO method were approximately $205 million and $185 million at December 31,2013 and 2012,respectively.Inventories consisted of the following: ($ in millions)

The LIFO reserve indicates that inventories would have been $91 million and 101 million higher at the end of 2013 and 2012,respectively,if Occidental Petroleum had used FIFO to value its entire inventory.

Required:

If Occidental Petroleum had used FIFO to value its entire inventory how would its 2013 pre-tax income be affected?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Appleton Inc.adopted dollar-value LIFO on January 1,2016,when

Q108: The table below contains selected financial information

Q110: On January 1,2015,ECT Co.adopted the dollar-value LIFO

Q112: The Foxworthy Corporation uses a periodic inventory

Q114: On January 1,2016,the National Furniture Company adopted