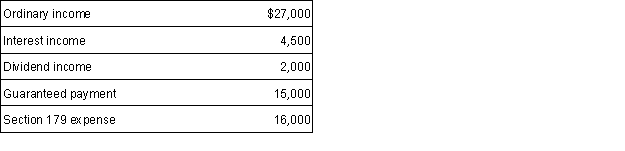

A partner had the following items reported on a partnership Schedule K-1:  The partner's self-employment income for the year is:

The partner's self-employment income for the year is:

A) $26,000.

B) $32,500.

C) $48,500.

D) $64,500.

Correct Answer:

Verified

Q44: Partner Jamie has a basis of $10,000

Q45: In 2014, Angel contributes land to a

Q48: Sabrina has a $12,000 basis in her

Q48: In 2014, Angel contributes land to a

Q49: Partner Spence had the following items reported

Q51: Partner Tami (a 20% partner) had the

Q52: A partnership has $23,000 of depreciation expense

Q53: As a general rule,a distribution to a

Q56: Rental income and expenses are treated as:

A)Ordinary

Q57: Sabrina has a $12,000 basis in her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents